Posted by Hawk on September 27, 2013

For those of you new to our site, you'll quickly see that you can find bankruptcy cases and download bankruptcy records easily and mostly for free. But that's just the beginning. We've actually built a complete interface to PACER with cloud storage capability. What does that mean?

Well for starters, it means that if you need to search PACER for anything, you can do exactly that through our site instead. Why bother? Because we store everything for you and add some great time saving perks. As you use our interface more and more, you'll quickly see that you get a personalized PACER experience with all your data persistently organized for you - think of it like a "myPACER."

Here are a few examples of how we improve the entire process of accessing PACER for free:

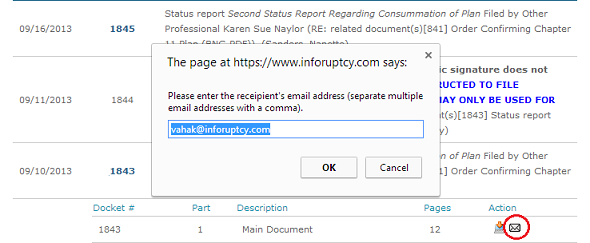

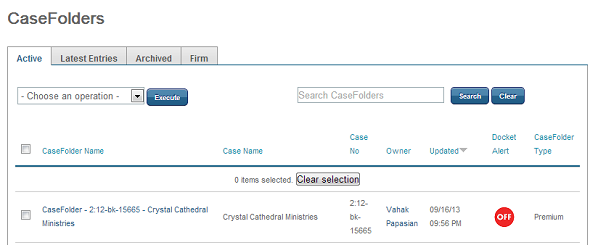

Free Storage -- Completely eliminate repeat purchases, including docket text

Any data you purchase through Inforuptcy is automatically stored in a CaseFolder for quick access later, so you never have to pay for the same information twice. This includes docket text, which you repeatedly have to pay for on PACER anytime you want to review the docket. You can even store and track cases for which you make no purchases.

You can read our blog on free cloud storage for more about this.

Free Search -- 10 cents starts adding up

No need to pay for every search. You're likely to find your case in our robust database, accessbile without login. You can also access the PACER case locator through our interface at no charge.

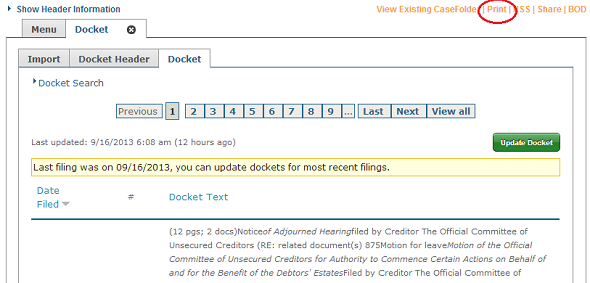

Tabbed Queries -- No need to click 'back' in the browser any more

Tab system allows you to switch between queries so no need to close your docket or find your case again in search to get back to the case menu.

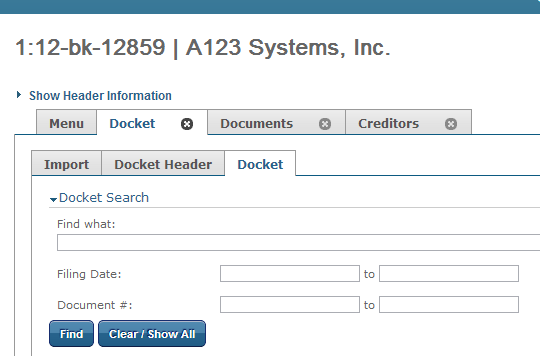

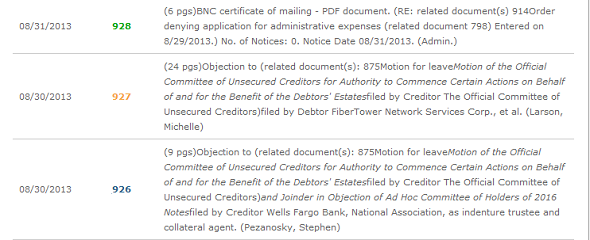

Docket Search -- No more 'CTRL F'

Keyword search a docket within a date or document range. Results are displayed with your keywords highlighted. Analyze long dockets and find exactly what you want within seconds.

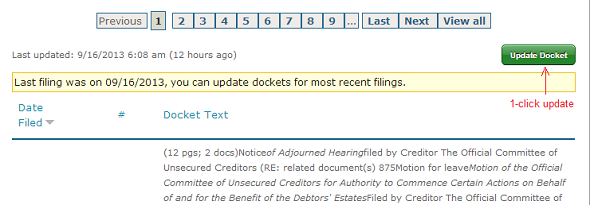

1-Click Update -- No need to purchase the docket over and over again

Every case, docket, and query can be instantly updated from PACER with 1-click, and you DON'T pay anything more than the usual PACER charge.

History -- One click to enter your docket vs four clicks on PACER

As you search through multiple cases, your history is conveniently displayed for you so you can jump back to recently viewed cases with 1-click.