Investor Pricing and Plans

Investors - We Put Bankruptcy Information at Your Fingertips

Choose Among a Daily, Monthly or Annual Plan to Signup

Starter

Toolset Included:

- Business Voluntary Petitions

Track chapter 7 and chapter 11 business bankruptcies across the country.

$39 /mo

Subscription auto-renews monthly until canceled. Cancel anytime by clicking "Cancel" in your account settings or email us at [email protected]. There are no refunds for any purchases of any kind.

Maverick

Toolset Included:

- Bankruptcy Assets Database

- Business Voluntary Petitions

Contact sellers, submit offers, track sales. The most comprehensive bankruptcy assets database. Great for overbidders of bankruptcy assets.

$99 /mo

Subscription auto-renews monthly until canceled. Cancel anytime by clicking "Cancel" in your account settings or email us at [email protected]. There are no refunds for any purchases of any kind.

Rain Maker

Toolset Included:

- Advanced Filings Search

- Bankruptcy Assets Database

- Business Voluntary Petitions

Great toolset for advanced asset buyers looking for key docket events or searching within PDFs.

$199 /mo

Subscription auto-renews monthly until canceled. Cancel anytime by clicking "Cancel" in your account settings or email us at [email protected]. There are no refunds for any purchases of any kind.

Game Changer

Toolset Included:

- Digitized Schedule A/B (Assets)

- Business Bankruptcy Schedules

- Advanced Filings Search

- Bankruptcy Assets Database

- Business Voluntary Petitions

Ultimate toolset for the experienced investor or auctioneer. Only solution to comb through the schedules of assets delivered to your inbox.

$299 /mo

Subscription auto-renews monthly until canceled. Cancel anytime by clicking "Cancel" in your account settings or email us at [email protected]. There are no refunds for any purchases of any kind.

All plans come with our PACER interface toolset so you can find, organize and track bankruptcy cases of interest

| Starter | Maverick | Rain Maker | Game Changer | |

|---|---|---|---|---|

| Main Toolsets | ||||

| Number of Users | Individual (1 person) | Firm (up to 5 people) | Firm (up to 5 people) | Firm (up to 10 people) |

| Business Voluntary Petitions | ||||

| Assets & Liabilities Data | ||||

| NAICS Industry Code | ||||

| Unlimited Saved Cases | ||||

| Unlimited Saved Searches | ||||

| Export Case Data | ||||

| Assets Database | - | |||

| Sale Motions | - | |||

| Docket Alerts | - | |||

| Advanced Search | - | - | ||

| OCR Searching | - | - | ||

| Asset Schedules | - | - | - | |

| Creditor Schedules | - | - | - | |

| Schedule A/B Assets Alerts | - | - | - | |

| Autopilot Case Monitoring | - | - | - | |

| Additional Features | ||||

| PACER 1-Click Access | ||||

| PDFs in Inventory | Free | Free | Free | Free |

| Cloud Storage & Organization | ||||

| Training | $49 / session | One free session | ||

| Support | Email or Phone | Priority | Priority | |

- We comb through all the courts to find asset sales so you do not have to

- Search the most comprehensive database of bankruptcy assets

- Use our sophisticated tools to automatically track cases of interest

- Receive daily email alerts of stalking horse opportunities

Search Through The Most Comprehensive Sale Motion Database

Assets

Assets

Database

We comb through nearly all the bankruptcy filings across the country, identify any assets for sale, create a

"cheat-sheet" of the most relevant information, and make it fully searchable in our database. You can then

simply contact the seller or dig further into each case as desired. Auto-track

Auto-track

Any Case

Once you have identified a case of interest, you can set up docket alerts to automatically track the court's

docket so you are always aware of amendments to the sale motion, new hearing dates, or objections to the sale.

Set email preferences to filter alerts received. Customize

Customize

Your search

Create custom alerts of assets of interest such as going concerns, financial assets, commercial property,

residential property, etc. to stay aware of the latest asset filings. Best for

Best for

Overbidders

Typically after the sale motion has been filed a stalking horse bidder has been identified. They have

completed their due diligence. As an overbidder, you can come in and swoop up the asset away from the stalking

horse bidder by offering a little more.The Most Comprehensive Business Bankruptcy Database

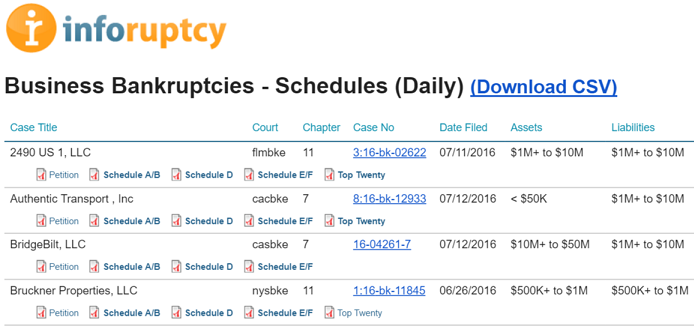

- Receive a daily email of all the newly filed business bankruptcy cases.

- Receive a daily email of all the newly filed schedules in business bankruptcy cases.

- Customize your emails based on your assets of interest.

Latest

Latest

Petitions

We track and purchase every business petition filed every day and across the country. We track the size of the assets and liabilities reported on the petitions and email you all the information. Latest

Latest

Schedules

Not only do we track all the business bankruptcy petitions, but we are also the only service to track every business bankrutpcy case until the initial schedule of assets and creditors is filed in each case. These business schedules are the earliest indication of the assets that could be possibly purchased. Digitized

Digitized

Schedule A/B

We are digitizing the summary of assets from Schedule A/B. This will allow prospective investors additional time saving tools to dig through the court filings and pinpoint assets of interest. Customized

Customized

Emails

Completely customize your daily emails to match exactly your search criteria such as size and type of asset, jurisdiction, etc.Search Across Bankruptcy Cases And Create Custom Alerts

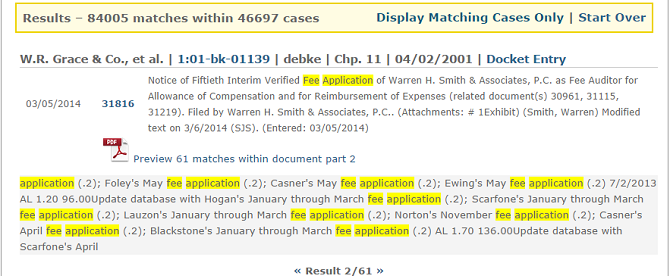

- Search through our extensive database across all cases and events.

- Includes full text searching of all PDF documents in our database.

- Use boolean operators and filters to quickly find what you need.

- Set criteria & receive email alerts when new entries match your search.

Find sample

Find sample

Pleadings

Are you looking for sample auctioneer employment applications? We have you covered. Looking for new confirmation plans? We have you covered. Generate

Generate

Leads

Identify assets in personal bankruptcy cases by searching for notice of assets or deadline to file proof of claim after the 341(a) meeting. Research

Research

Issues

Find how judges have ruled on stalking horse bid protections or DIP financings. Receive

Receive

Alerts

Conduct searches, refine your lists, and once you're satisfied with the results, set alerts with one click. New results matching your criteria in our database can be checked and emailed every hour, day or week.These are some common uses cases, but you'll have your own. Find what you need within minutes instead of hours or days.

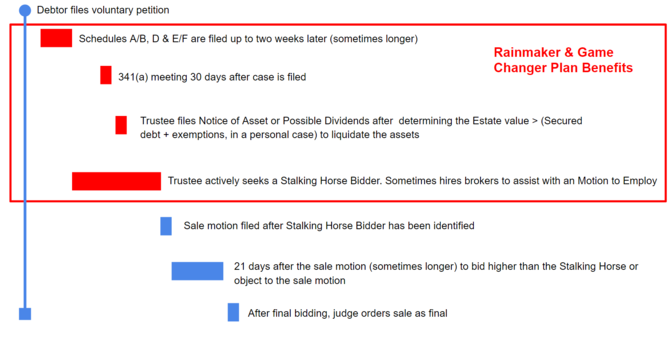

Typical timeline for a chapter 7 bankruptcy case illustrates some of the differences among the plans

- Maverick plan best for overbidders.

- Game Changer plan best for stalking horse bidders and auctioneers.

- Schedule a demo to learn more about the differences.

Not sure if you're ready to start investing in bankruptcy asset sales? Dip your toes with our free newsletter.

Frequently Asked Questions

The best way to start learning something is by doing. Of course some preliminary reading can really help. Here are some helpful articles to get you started:

For a quick overview: Bankruptcy Asset Sales Overview.

For buying real property: 4 Tips for Investors [Real Estate, Houses].

Ultimately though, you will need to talk to sellers and see for yourself how different each deal can be. Using our Bankruptcy Assets Database, you can quickly pick deals of interest, read about each sale, talk to sellers and even listen in on an auction or two. By preparing yourself with "practice" deals, you'll be able to better take definitive action when you spot that "sweet" deal you've been waiting for.Bankruptcy assets provide an opportunity for profit or to acquire otherwise unique or hard to find assets. Whether you're looking to "turn around" a troubled company, or acquire some unique art, all sorts of assets get sold through the bankruptcy courts.

Of course, any great deal requires some work. Not every asset in bankruptcy will provide a profit opportunity. Often sellers in bankruptcy have marketed the assets fairly well. However, sometimes, that is not the case. Sometimes there will be emergency motion in court because a compelling business reason does not allow sufficient time to properly market an asset. It usually comes down to a matter of timing. What does that mean for you? It means you need to be patient and follow a system of looking through listings we provide. Like most investing, being methodical will usually yield to more favorable results.In general, throughout any given year, thousands of assets get sold through the bankruptcy courts. On a monthly basis, there are hundreds of new assets, but most assets are for sale only for 30-90 days. As a result, at any given point in time, we provide a set of listings totaling about 500-700, but this inventory is constantly changing.

If you want to specifically know about a particular asset type, you can browse our expired listings to see what's been listed previously.Pay attention to the objection period and sale dates. Much of the deals noticed for sale in the bankruptcy court will be the result of an existing agreement between the seller and a potential buyer. However, the Trustee wants to get as much as he/she can for the bankruptcy estate and will typically welcome better offers so long as it's within the time-line of the bankruptcy process. No sale is final until the court enters an order approving the sale, but there is usually a time period after which a better offer may not be accepted. This is typically after the objection period expires (but NOT always). Prior to that time, you can review the relevant terms of the contract between the seller and buyer, and provide a higher or better offer on the property if desired.

If the property had not been effectively marketed prior to the sale motion, or the bankruptcy caused most potential buyers to "drop out," it is quite possible there is significant room to make a higher or better offer while still remaining below open market value (in other words, the market value of the property assuming no bankruptcy was filed).